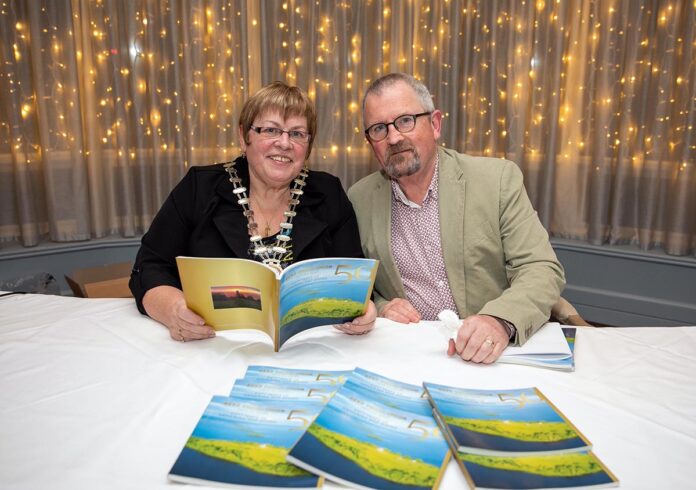

TO celebrate the 50th anniversary of Derg Credit Union in Killaloe and Scariff, a former board member Jim O’Brien, launched his historical account of the institution at the Killaloe Hotel, writes Conor Clohessy.

While no longer a board member, he currently serves as a volunteer on the promotions and development committee. He works as a freelance journalist.

Jim was approached about compiling the piece of work by two of the longer serving members of the board, William McLysaght and Michael Cleary, who were both present at the founding of Derg Credit Union in 1971.

Jim said: “They asked if I would write this as part of the commemoration, and it was a huge amount of work. I had to read fifty years’ worth of minutes, which was time-consuming, but it was inspirational to see what these people have achieved.”

The momentous feat began with the reading of said minutes last March, which was an endeavour that had be completed within the confines of the credit union building, as Jim was bound by protocol not to take them from the premises.

Jim considers himself lucky to have had access to them at all times, though the research process took him a lot longer than he had anticipated.

He continued that accuracy was at the soul of the book, and the minutes were at the core of that accuracy, because word of mouth accounts would often report events a few years, or sometimes a decade, too early or too late.

Jim added: “It was very interesting to look at, especially back in the early stages of the credit union. Board meetings happened once a month and because it was a voluntary organisation, there were no executive decisions being made on the ground.

“If a thing was postponed, it was postponed by a month – for instance, the buying of a calculator took six months. That’s not because they were inefficient, it was because meetings were so stretched out.”

The author also noted that the early emphasis was on getting people to save and to buy shares, but when the time came for the credit union to encourage loans, there was an embarrassment culture attached to borrowing money at all.

Jim attributed this to the local nature of the credit union, the fact that everyone would know the business of the borrower; he noticed that there was a difficulty to convincing locals that the affair of a credit union was simply to share and loan money.

There were also insights galore throughout Jim’s research into the trends of borrowing decades ago; one such example was to the tune of £40, for a holiday.

Jim pointed out: “Most people didn’t have bank accounts, back then. They had nowhere to go if they needed a few pounds, unless they had some stowed under the mattress. That’s the beauty of it.

There was still a shame in it, to go somewhere for a loan of only £20 or so, but as they got used to it, the locals were delighted to go to the credit union for that kind of money.”

In terms of the kinds of loans being taken out, Jim highlighted that the list hasn’t changed very much; car loans have always been at the very top, and in the 70s and 80s, borrowing for the

tax and insurance of that car was common as well.

Household loans have been the bedrock of most of Derg Credit Union’s business beyond that, since the beginning – the very first loan given from their accounts was for a sewing machine.

Additionally, farm loans for stock, land and equipment were popular throughout the decades, because they could be given out as personal loans; it was also common to take out a loan in order to tide a farm over for a month or two during an ebb in cash flow.

Jim concluded: “If anything surprised me during my research, given the type of society we have emerged into, it was the amount of time the volunteers put into the credit union.

“The fact that they were willing to take this on, and in effect to found a local bank with people’s money. Volunteers were out every night at meetings or acting as tellers.

“For instance, there were collection points all over East Clare, in places like Feakle, Bodyke, Broadford, Flagmount and others. They had to be staffed on a Friday night for two hours, and accounts had to be kept and balanced, then brought to Scariff.”

The writer expressed a certain nervousness about unveiling the book, due to wanting to do justice to the amount of work done over the last fifty years; Jim commended the staff in Derg Credit Union for their help in proof-reading, as he worked.

Derg Credit Union began with €2000 in shares and now holds over €30 million in assets, with two state-of-the-art offices and ten staff.